social security tax rate 2021

Filing single single head of household or qualifying widow or widower with 25000 to 34000 income. Read More at AARP.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Retirees who have several sources of income including pensions retirement account withdrawals or part-time work might have to.

. B One-half of amount on line A. Social Security and Medicare Withholding Rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. What is the Social Security tax rate.

The Social Security tax limit is the maximum amount of earnings subject to Social Security tax. The Social Security Wage Base means that youll only ever pay Social Security taxes on 147700 and nothing else. Worksheet to Determine if Benefits May Be Taxable.

For both 2021 and 2022 the Social Security tax rate for employees and employers is 62 of employee compensation for a total of 124. The current rate for. 62 of each employees first 142800.

Workers pay a 62. Any income you earn beyond the wage cap amount is not subject to a 62 Social Security payroll tax. Beginning in tax year 2020 the state exempted 35 percent of benefits for qualifying taxpayers.

For 2021 the maximum taxable earnings limit is 142800. AVERAGE EMPLOYER SOCIAL SECURITY TAX - NORTHERN EUROPE - Country SST Rate 2021 Population 2020 Sweden 3142 10099265 Finland 2066 5540720 Norway 1410. For taxes due in 2021 refer to.

Thus the most an individual employee. The employers Social Security payroll tax rate for 2021 January 1 through December 31 2021 is the same as the employees Social Security payroll tax. Ad When Do You Have to Pay Income Taxes on Your Social Security Benefits.

If SS benefit exceeds 34K then taxable portion is 85 of your SS benefits. That is a 5100 increase from the. 2021 Social SecuritySSIMedicare Information Social Security Program Old Age Survivors and Disability Insurance OASDI 2021 Maximum Taxable Earnings.

Under the change that deduction will be unlimited effectively. A Amount of Social Security or Railroad Retirement Benefits. Anything you earn over that annual limit will not be subject to Social Security taxes.

In addition your future benefit amount will not. For example an employee who earns 165000 in 2022 will pay 9114 in. That is a 5100 increase from the 2020 wage-based cap.

In 2021 you will pay Social Security taxes on all of your income up to 142800. You would do the same but multiply by 124 if youre self-employed. I applied for windows benefits and was told that I would.

Their income used to determine if Social Security bene ts are taxable 37500 is greater than the taxable Social Security base amount 32000 for joint lers. For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security. D Tax-exempt interest plus any exclusions from income.

Those who are self-employed are liable. Quarter of 2019 through the third quarter of 2020 Social Security and Supplemental Security Income SSI beneficiaries will receive a 13 percent COLA for 2021. Social Security taxes in 2022 are 62 percent of gross wages up to 147000.

You cant pay more than 18228 in taxes for Social. Nobody Pays Taxes on More Than 85 of Their Social Security Benefits. Fifty percent of a taxpayers benefits may be taxable if they are.

March 15 2021 644 AM 5 min read. The Social Security taxable maximum is 142800 in 2021. As of 2021 that amount increased to 65 percent and in 2022 the.

Currently taxpayers can deduct up to 24000 of social security income from their Colorado taxable income. Anything you earned over this threshold is exempt from Social Security tax. C Taxable pensions wages interest dividends and other.

SS benefit is between 232K 44K then taxable portion is 50 of your SS benefits. My husband died July 30 2021 and we were both receiving social security retirement benefits which was our only income.

Social Security Taxes 2022 Are Payroll Taxes Changing In 2022 Marca

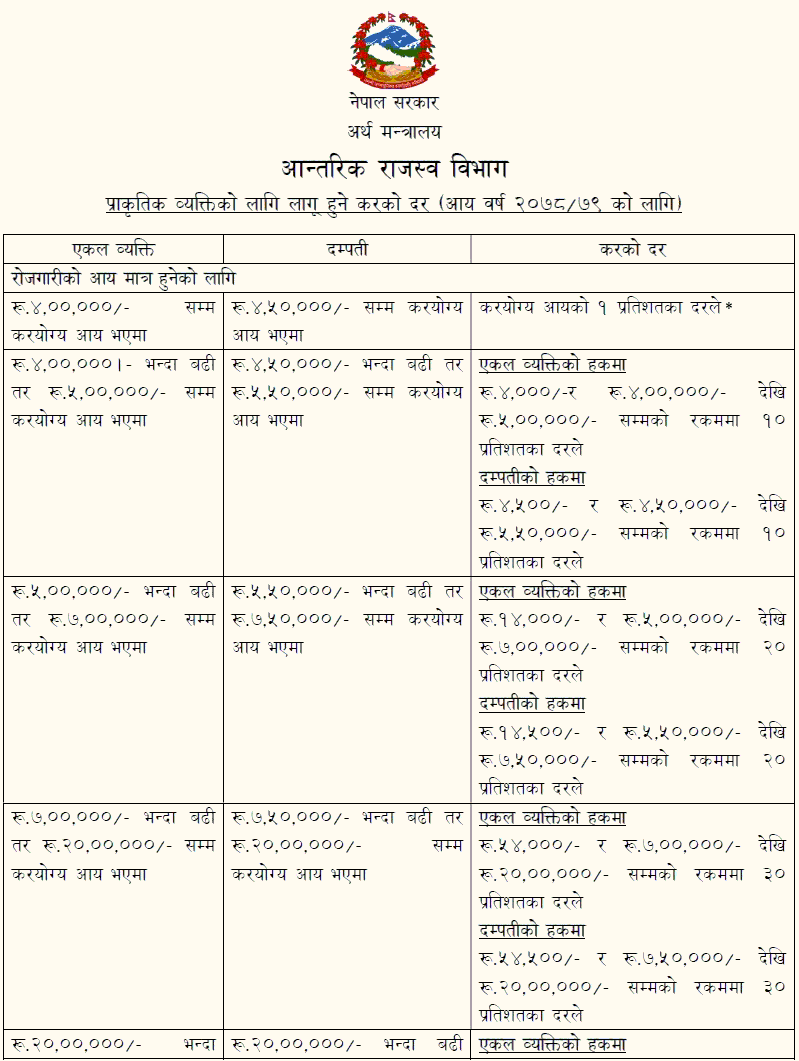

Tax Rate In Nepal For Fiscal Year 2078 2079 2021 22 Collegenp

Fica Tax Guide 2021 Payroll Tax Rates Definition Smartasset

Understanding Your Tax Forms The W 2

Social Security Wage Base Increases To 142 800 For 2021

The Social Security Wage Base Is Increasing In 2022 Sensiba San Filippo

How Much Does A Small Business Pay In Taxes

Social Security Tax Limit For 2022 Explained Fingerlakes1 Com

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Social Security Disability Income H R Block

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)